Know Your Customer (KYC)

We offer a complete solution for KYC & AML (Anti-Money Laundering), including identity document verification, admin dashboards, and re-submission management. Our KYC/AML service lets you whitelist the BTC or ETH addresses of purchasers to allow them to safely purchase tokens in any jurisdiction.

IDENTITY

OMINEX offers flexible solutions for verifying the identity of consumers worldwide. OMINEX allows clients to verify users through identity document verification, consumer data verification, or a combination of the two methods. Either approach to verification can be combined with dynamic knowledge-based authentication and phone verification for a comprehensive solution to affirm that a consumer is who they claim to be.

RESIDENCY

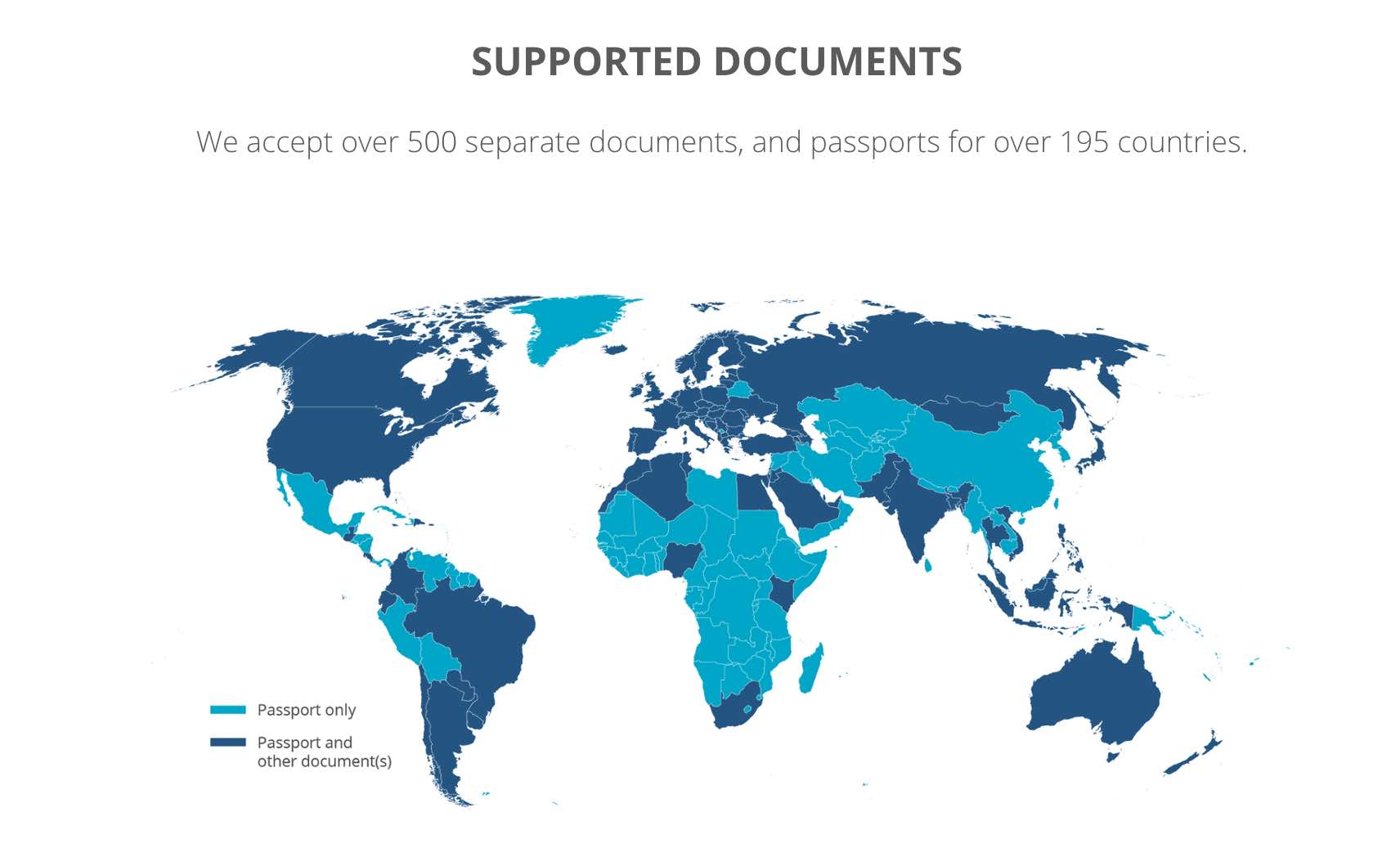

OMINEX has multiple methods for verifying country of residence. Not only can we block users from blacklisted countries, but also you can build your own custom firewall and rules for each country based on different compliance standards. We can verify documents from 195 countries and support over 500 different identity documents. Social Security Number Validation is also available in the US.

SUITABILITY QUESTIONS

Broker-Dealers must ensure that customers purchase suitable investmens, firms are required to learn as much about a customer’s investment profile as possible. The rule requires firms and associated persons to seek to obtain information about the customer’s age, other investments, financial situation and needs, which might include questions about annual income and liquid net worth, tax status, investment objectives, investment experience, investment time horizon, and risk tolerance. Click here for more information

OFAC COMPLIANCE

The Office of Foreign Assets Control (OFAC) is the name given to the division of the U.S. Department of the Treasury that is responsible for enforcing U.S. economic trade sanctions as prescribed by U.S. national foreign policy. As part of OFAC's enforcement strategy, the office pays particular attention to countries and regimes suspected of plotting against or damaging U.S. national security. Under the power of OFAC, U.S. citizens are prohibited from engaging in business with individuals and organizations mentioned on the Specially Designated Nationals (SDN) List.

PEP LIST SCREENING

Financial Institutions are required to perform due diligence in transactions involving Politically Exposed Persons (PEPs). While there is not a global standard definition regarding PEPs, the term generally refers to foreign officials and senior foreign political figures. The first step toward compliance with the Know Your Customer (KYC) and Anti-Money Laundering regulations impacted by PEPs is identifying those individuals during the initial enrollment or transaction. OMINEX offers the flexibility to make the process of identifying PEPs easy.

EU AND UK SANCTIONS

The UK Government and European Union maintain consolidated lists of sanctions applied against individual, entities, and countries. While there is frequently overlap between these lists, as well as overlap with other sanctions, the EU and UK also may apply restrictive measures autonomously. In the UK, HM Treasury is responsible for maintaining financial sanctions, and the EU sanctions are maintained by the European Union External Action Service (EEAS). Companies doing business in the EU and/or UK, as well as those businesses transacting with EU and UK residents, need to screen against both sanctions lists to ensure that they are in compliance.